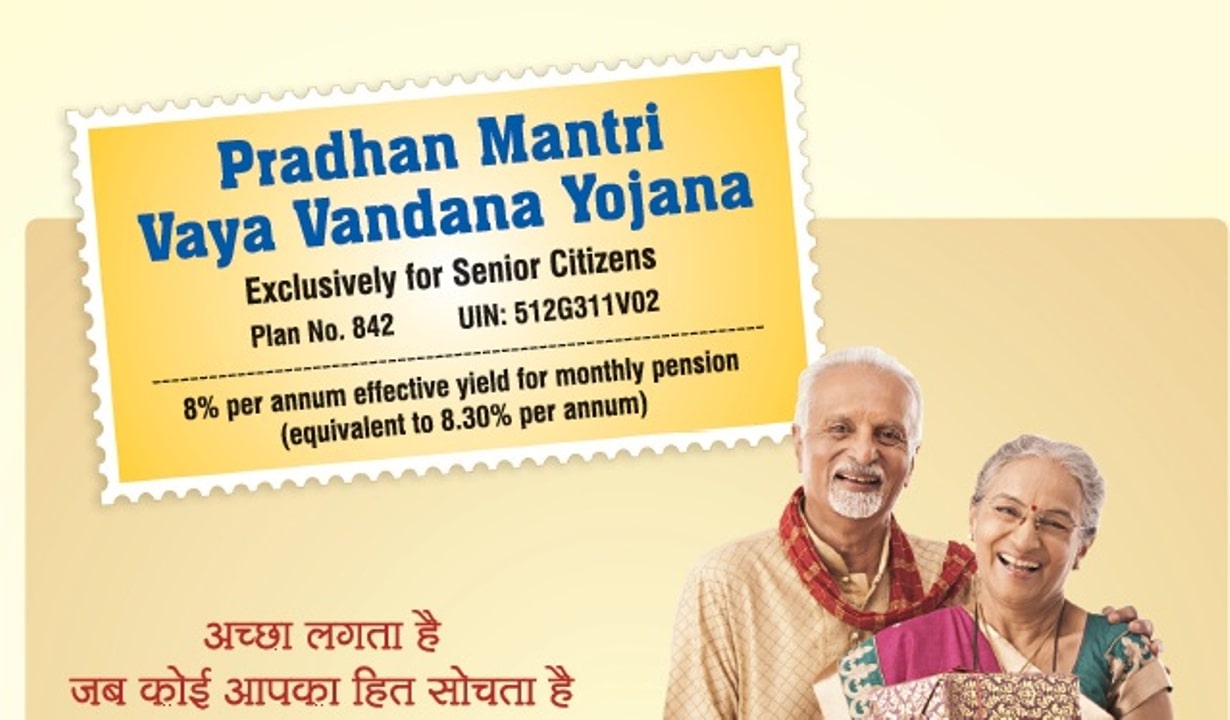

Pradhan Mantri Vaya Vandana Yojana 2022 Apply Online, PMVVY Registration, Eligibility, Benefits, Interest Rate, Calculator, Beneficiary List

The Government of India has been doing its bit for the elderly and the older generation of India. So in the recent speech on the budget for the year 2021, the concerned authorities announced the Pradhan Mantri Vaya Vandana Yojana for the year 2022. In this article today, we will share with you all the details about the loan scheme which will be implemented for the elderly people of India. In this article, we have provided eligibility criteria, benefits, features, and all the other procedures related to the scheme.

Table of Contents

Pradhan Mantri Vaya Vandana Yojana 2022

Under the Pradhan Mantri Vaya Vandana Yojana, insurance will be provided to the elderly people of India. Under the insurance, many benefits and incentives will also be availed for the older generation so that they can lead their life happily and without any trouble or financial burden. The implementation of this scheme will take place in the year 2020 and thus it will clarify all the financial burdens that the older generation is going through.

Details Of PMVVY Scheme 2022

| Name | Pradhanmantri Vaya Vandana Yojana |

| Launched by | Central Government |

| Launched in | All Over India |

| Objective | Providing Insurance Facilities to the Elderly Generation |

| Beneficiaries | Old People Above the Age of 60 Years. |

Pradhan Mantri Vaya Vandana Yojana Application Form

The amount of pension will be provided 1 year, 6 months, 3 months, and 1 month later after the submission of the first installment of the Pension Yojana on the basis of the premium plan you choose to buy. Desired applicants can apply for the PMVVY scheme either through online mode or offline mode. To apply online mode, you have to visit the official website of the Yojana and apply there. To apply via offline mode, you have to visit the nearest LIC Office and submit your documents there. The concerned LIC agent will register you in the scheme and start your policy program as per your choice.

Pradhan Mantri Rojgar Protsahan Yojana

PMVVY Update

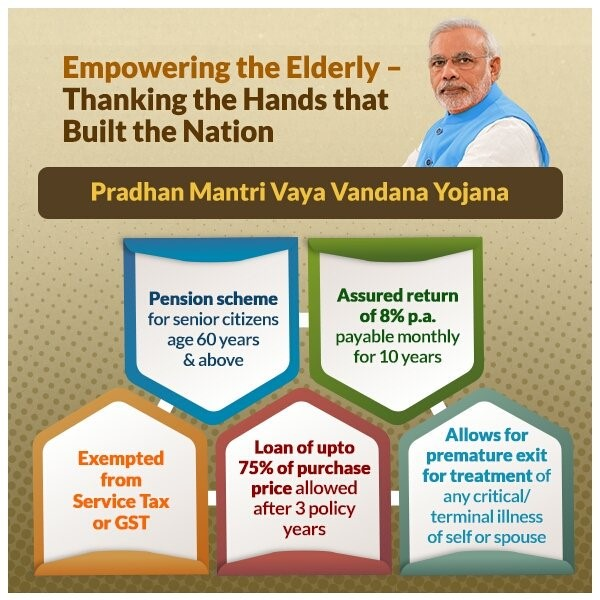

In the latest updates on 20 May 2020, the cabinet has approved the extension of Pradhan Mantri Vaya Vandana Yojana (PMVVY) for a further period of 3 years i.e. 31 March 2023. This will ensure old age income security and the welfare of Senior Citizens. The Yojana will provide an effective interest rate for senior citizens on certain investments through a Life Insurance Company (LIC)

PMVVY Features

Certain features of the Pradhan Mantri Vaya Vandana Yojana are given below:-

- Monthly, quarterly, half-yearly, and annual modes are the different modes of payment that are available in the scheme.

- The payment of the pension will be done via Aadhaar Enabled Payment System or National Electronics Fund Transfer (NEFT).

- If there are any Statutory Taxes that have been imposed by the Indian Government or another constitutional tax Authority of India, they will be as per the tax laws and the tax rates that are applicable.

- For the calculation of benefits that are payable under the PMVVY scheme, the amount of tax that is paid will not be taken into account.

- Only for treatment of terminal or critical illness for the policyholder of his/her spouse, is the premature exit from the policy allowed. 98% of the Purchase Price must be paid as the Surrender Value.

Mukhyamantri Vridhjan Pension Yojana

Benefits Of The Pradhan Mantri Vaya Vandana Yojana

As mentioned above, there are many benefits of the Pradhan Mantri Vaya Vandana Yojana that will be implemented for the older generation of India. Some of the benefits are mentioned below:-

- The pensioner will receive an assured return of 8% p.a. for the policy for the duration of 10 years.

- In case the pensioner survives the duration of the policy, the pension will be paid in arrears.

- The pensioner has the right to choose the mode by which the pension must be made.

- The purchase price will be paid back to the beneficiary if the pensioner passes away during the policy tenure.

- If the pensioner survives the entire policy tenure, the purchase price will be paid along with the final pension installment.

- After completing 3 years of the policy, the pensioner can also avail of loans against the policy.

- A maximum of 75% of the purchase price can be availed as a loan.

- The interest on the loan will be recovered from the pension payment that is being made.

- The policyholder can surrender the policy within 15 days if he/she is not happy with the terms of the policy.

- The free-look period is 30 days if the policy is bought online.

- The purchase price after the deduction of stamp charges will be refunded to the policyholder.

PMMVY Eligibility Criteria

To be eligible for the Pradhan Mantri Vaya Vandana Yojana for the years 2019 and 2020, you must follow the following eligibility criteria given below:-

- The applicant must be 60 years of age to apply for the scheme.

- There is no upper limit for age

- The tenure of the policy is 10 years.

- The minimum pension amount is, as such-

- Month- Rs.1,000

- Quarter- Rs.3,000

- Half-yearly- Rs.6,000

- Yearly- Rs.12,000

- The maximum pension amount is, as such-

- Month- Rs.10,000

- Quarter- Rs.30,000

- Half-yearly- Rs.60,000

- Yearly- Rs.120,000

PMVVY Required Documents

- Passport Size Photo

- Mobile Number

- Aadhar Card

- Pan Card

- Income Certificate

- Age Certificate

- Bank passbook Details

Purchase Price Of The Pradhan Mantri Vaya Vandana Yojana

To purchase the scheme you will have to pay the following prices in lump-sum amounts-

| Pension mode | Minimum Purchase Price (Rs.) | Maximum Purchase Price (Rs.) |

| Monthly | 1,50,000 | 15,00,000 |

| Quarterly | 1,49,068 | 14,90,683 |

| Half-yearly | 1,47,601 | 14,76,015 |

| Yearly | 1,44,578 | 14,45,783 |

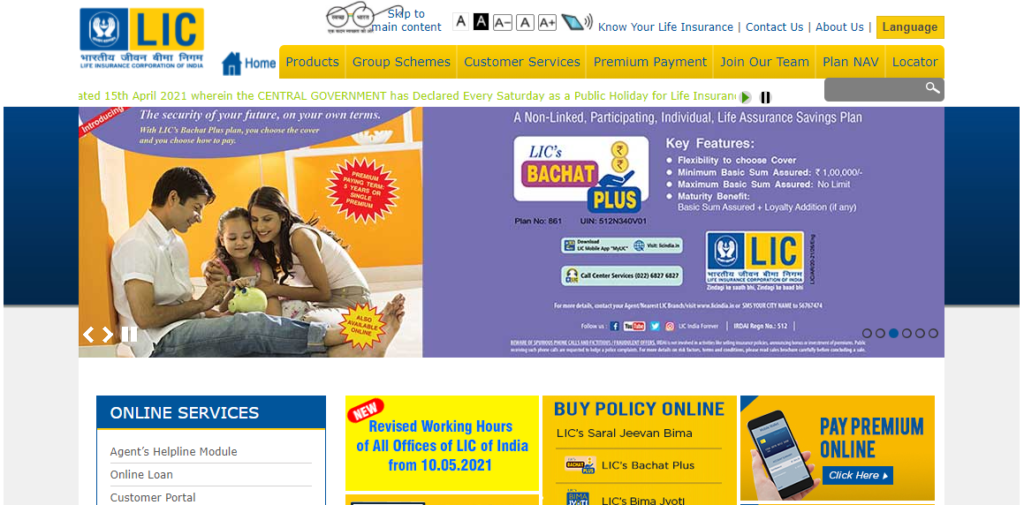

Application Procedure Of Pradhan Mantri Vaya Vandana Yojana

To apply for the Pradhan Mantri Vaya Vandana Yojana, you must follow the simple steps given below:-

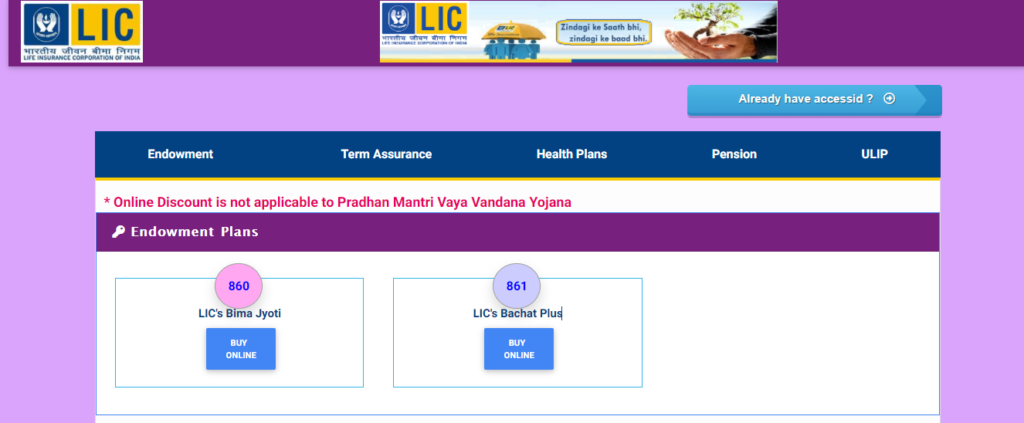

- First, you have to visit the official website of LIC India

- After you visit the homepage, click on the Pradhan Mantri Vaya Vandana Yojana link present there.

- Finally, you have to purchase the scheme as per your requirement.

PMVVY Scheme Apply Offline

- To apply through offline mode for the Pradhan Mantri Vaya Vandana Yojana, the applicant has to visit the nearest LIC Office.

- Now go to the concerned department and ask for the registration.

- Submit your required documents to the LIC agent preceding the registration process.

- Choose your policy plan as per your requirements.

- After all the required submissions, the LIC agent will start your policy plan after 24 hours.

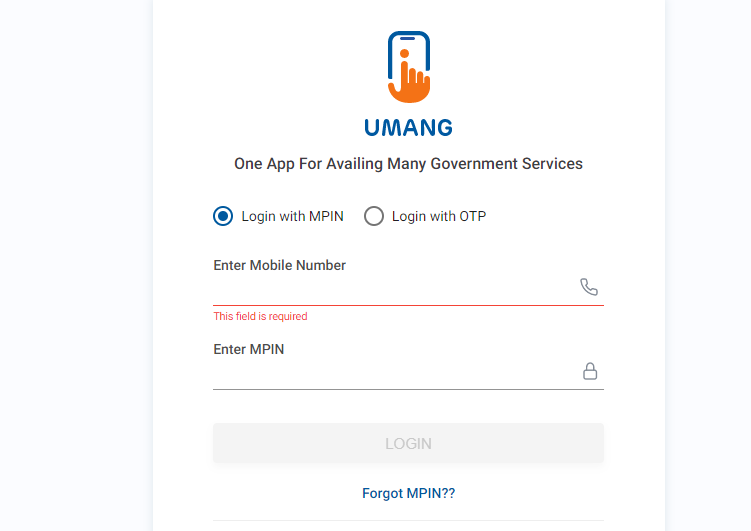

Get Policy Details

- To get your policy details, you must click here first.

- This will lead you to a new page.

- Now on this page, you have to click on the get basic policy details option.

- This will lead you to a new page where you will find an application form.

- On this page, you have to enter your registered mobile number.

- Also, you have to select the login type as MPin or OTP

- Now click on the login option.

- The basic policy details will be displayed

Policy Loan Details

- To get your policy details, you must click here first.

- This will lead you to a new page.

- Now on this page, you have to click on the get Policy Loan Details option.

- This will lead you to a new page where you will find an application form.

- On this page, you have to enter your registered mobile number.

- Also, you have to select the login type as MPin or OTP

- Now click on the login option.

- The basic policy details will be displayed

Submit Grievance

- First, you have to visit the official website of LIC India.

- After you visit the homepage, click on the Grievance option present there.

- This will lead you to a new page.

- Now click on the Register Grievance option.

- A login form will open on the screen.

- Enter the login details and register the grievance.