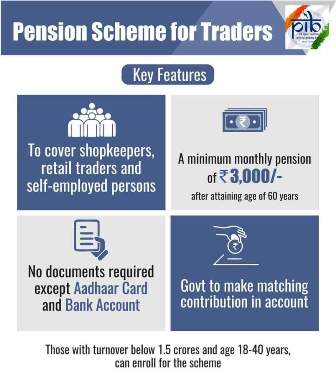

After winning the 17th Lok Sabha Election in the month of June 2019 Mr. Narendra Modi has announced PM Laghu Vyapari Mandhan Yojana or National Pension Scheme for Small Traders of Country. The Small Traders whose Annually Turn Over is Up to 1.5 Crore Rupee and they have registered under the Goods and Services Tax (GST) may avail all the benefits of PM Laghu Vyapari Mandhan Yojana. National Pension Scheme for Small Traders will work as an old-age pension scheme.

Table of Contents

National Pension Scheme For Small Traders

PM Vyapari Mandhan Yojana was established for the merchants or the small businessman, who carry on the day to day business with a minimum of stock or inventory always in their garage, outlets or shops. The PM Laghu Vyapari Mandhan Yojana provides insurance facilities for the opening and closing stocks of the merchants and businessmen, so that they can bear the loss of the goods and product if it is any.

Aim Of Laghu Vyapari Pension Scheme

The aim of PM Laghu Vyapari Mandhan Yojana is very wide and it has vital welfare for the people of the state and a resident of the country. PMLVMY Scheme will empower small traders Future after the age of 60 years. Any Small trader or Laghu Vyapari whose age is between 18 to 40 years can enjoy all the benefits of the scheme, under the PM Laghu Vyapari Mandhan Yojana Central Government will pay 50% amount of total premium on a monthly basis.

Overview of PM Laghu Vyapari Mandhan Yojana 2023

| Scheme Name | PM Laghu Vyapari Mandhan Yojana |

| Launched by | PM Narendra Modi |

| Launched Date | 31st May 2019 |

| Start to enroll | Available Now |

| Last date to enroll | Not yet Declared |

| Beneficiary | Small Traders and Shopkeepers |

| Benefits | Rs 3000 after 60 years age |

| Number of beneficiary | 3 crore Small Traders |

| Mode of Application | Online |

| Apply Online Website | http://maandhan.in |

Benefits In National Pension Scheme For Small Traders

Many benefits are provided under the Pradhan Mantri Laghu Vyapari Mandhan Yojana. The list of benefits are as follow:-

- The first and fore most benefit is on the maturity of the scheme, the beneficiaries will be entitled to obtain a monthly pension of Rs. 3000/-

- The pension amount helps pension holders to aid their financial requirements. The financial help will make the businessmen economically secure.

- The scheme is a tribute to the workers in the Unorganized sectors who contribute around 50 percent of the nation’s Gross Domestic Product (GDP).

- The applicants between the age group of 18 to 40 years will have to make monthly contributions ranging between Rs 55 to Rs 200 per month till they attain the age of 60.

- Once the applicant attains the age of 60, he/ she can claim the pension amount.

- Every month a fixed pension amount gets deposited in the pension account of the respective individual. Thus, the benefits will help the businessman secure social security through their goods and inventory.

How much contribution will have to be made in PMLVMY

| Entry Age in Years | Superannuation Age | Member’s Monthly Contribution | Central Govt’s Monthly Contribution | Total Monthly Contribution |

| 18 | 60 | 55 | 55 | 110 |

| 19 | 60 | 58 | 58 | 116 |

| 20 | 60 | 61 | 61 | 122 |

| 21 | 60 | 64 | 64 | 128 |

| 22 | 60 | 68 | 68 | 136 |

| 23 | 60 | 72 | 72 | 144 |

| 24 | 60 | 76 | 76 | 152 |

| 25 | 60 | 80 | 80 | 160 |

| 26 | 60 | 85 | 85 | 170 |

| 27 | 60 | 90 | 90 | 180 |

| 28 | 60 | 95 | 95 | 190 |

| 29 | 60 | 100 | 100 | 200 |

| 30 | 60 | 105 | 105 | 210 |

| 31 | 60 | 110 | 110 | 220 |

| 32 | 60 | 120 | 120 | 240 |

| 33 | 60 | 130 | 130 | 260 |

| 34 | 60 | 140 | 140 | 280 |

| 35 | 60 | 150 | 150 | 300 |

| 36 | 60 | 160 | 160 | 320 |

| 37 | 60 | 170 | 170 | 340 |

| 38 | 60 | 180 | 180 | 360 |

| 39 | 60 | 190 | 190 | 380 |

| 40 | 60 | 200 | 200 | 400 |

Eligibility In PM Laghu Vyapari Mandhan Yojana

- This scheme is only for self-employed shop owners, retail owners, and other vyaparis.

- Age should be between 18 to 40 years

- Annual turnover should not exceed Rs 1.5 crore.

- GST Registration

- Udhyog Aadhaar Registration

- Beneficiary Aadhaar Card

Silent Features of PM Laghu Vyapari Mandhan Yojana

- Life Insurance Company (LIC) will work as a nodal agency for the pension scheme.

- 50 Percent Government Funded Scheme.

- Pension will be provided after the age of 60 years

- This Pension Amount will be transferred in direct bank account on monthly basis.

- Your Aadhaar Card must be linked with your Bank Account Number

How To Apply For PM Laghu Vyapari Mandhan Yojana 2023

- Any citizen who wishes to Enroll under the PMLVMY Scheme, Firstly he/she should check their eligibility under the Scheme.

- After that Visit to the Mandhan Yojana Official Website and click on the “Apply Online” Option.

- There are two method of PM Laghu Vyapari Mandhan Yojana Enrollment is available at the Official Website First “Enrollment through CSCs” and Second “Self Enrollment”.

Enrollment Through CSCs

- First, the applicants need to visit the nearest Common Service Centre (CSC).

- Before visiting the common services Centre the applicant should have the following documents kept ready –

- Aadhaar Card

- Savings Bank Account Number along with IFSC Code ( Bank Passbook or Cheque Leave/book or copy of bank statement as evidence of bank account )

- A fee must be provided to Village Level Entrepreneur (VLE)

- The VLE will link the Aadhar Card details to the application form.

- Then the personal and bank details will be filled by the VLE

- Auto calculation of monthly contribution payable according to age of the Subscriber will be done

- Subscriber will have to pay the 1st subscription amount in cash to the VLE.

- Enrolment cum Auto Debit mandate form will be printed and will be further signed by the subscriber.

- VLE will scan the same and upload it into the system.

- A unique Kisan Pension Account Number (KPAN) will be generated and Kisan Card will be printed.

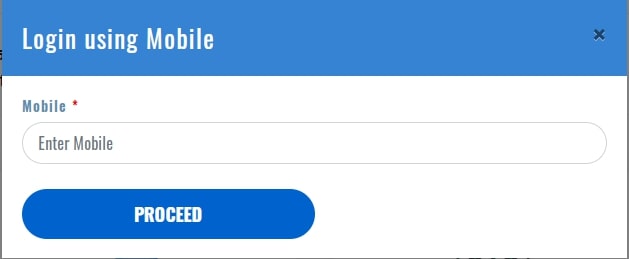

Self Enrollment

- First of All Registered Yourself

- The applicants must provide their phone number at the given space.

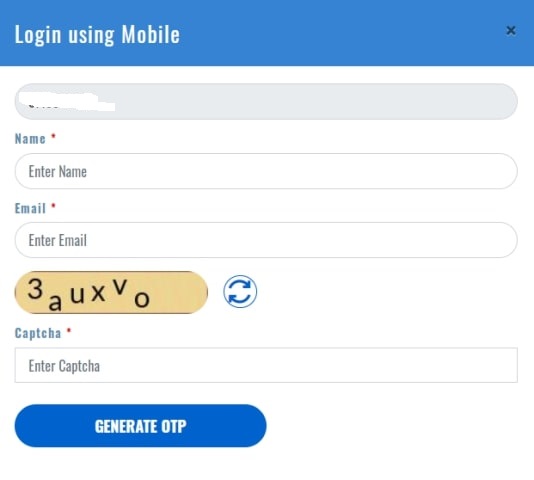

- Provide other asked details such as name, email and captcha code.

- Click on generate OTP.

- Enter the OTP sent on your registered phone number.

- After the Successful Registration under the Mandhan Pension for All Portal Login With your Email ID and Mobile Number.

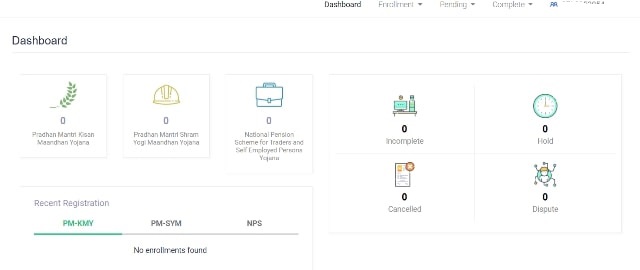

- Now at After The Successful Login you will get Enrollment Option Click on this Option and then Choose “National Pension Scheme” Option.

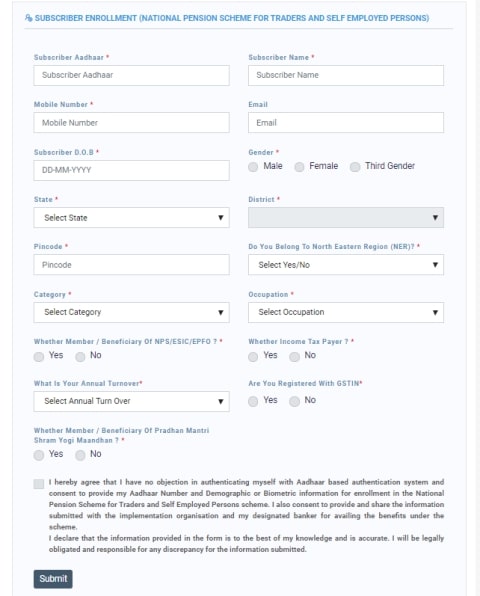

- After that “NPS Enrollment Form” will open in front of you like this.

- Now Fill all the required Details Carefully and in the last click on the submit button.