IGR Maharashtra plays a very important role if anyone wants to buy a property state of Maharashtra. The legal procedures start at the time you decide to buy the property and end when the government officials clear everything. This entire process will be completed through IGR Maharashtra. IGR Maharashtra is required to register your sale deed after paying stamp duty and registration charges. IGR is given the whole charge of this procedure. The website for the Inspector General of Registration & Stamps has been made with the aim to provide online services to people related to property. This website has been maintained by the Department of Registration & Stamps, Government of Maharashtra. With the help of this online portal, online property registration and documentation can be done easily.

All the work related to registering property and other documents in Government records is managed by IGR. Through this process, Inspector General of Registration (IGR) is able to collect lots of amounts. The amount is collected through stamp duty and other charges on documents such as leave and license registration, mortgage, etc.

Table of Contents

IGR Maharashtra 2023

The Inspector General of Registration (IGR) is the state government authority that sees all official work related to property registration. The official work includes registration of property documents, valuation of property, property tax computation, calculation, and payment of stamp duty amount. IGR makes sure that the people of Maharashtra should go according to the compulsory provision of registering any fixed/immovable property. IGR Maharashtra is known as the most digitally advanced department in India. Earlier, people have to visit the office of the Sub-registrar to comply with the legal work related to buying a property. But now things have changed, and a lot of development has been done by the state government. Presently, the residents of Maharashtra can use the website of the IGR Maharashtra gov to collect and register their property-related documents. In this online process, registration can be done well on time.

The main responsibility of the website of IGR is to register the documents and collect revenue. If the resident of the state wants to know about the number of documents registered daily, monthly or yearly, then it can be done by visiting the IGR Maharashtra official website. People can take benefit from this online facility for free, they easily search documents online. To take benefit of the online facility the residents can visit the website at igrmaharashtra.gov.in.

Online Services Available on IGR Maharashtra

Through IGR Maharashtra, the state government is providing many facilities to its citizens. Some of these features can also be accessed online. These features are given below.

- Property e-registration (first sale only). From March 2021, Only some developers and MHADA can take advantage of this facility.

- Wedding (Marriage) license

- Sub-Registrar time slot booking

- Property valuation

- Stamp duty application and related services like refund, etc.

- Mortgage deed e-filing (This facility is available for banks as well as users)

Calculation Of Stamp Duty In Maharashtra

Stamp duty is a tax that government imposes on documents that are required to be recorded legally. It is an amount that has to be paid at the time of registering a legal document with the Government. This tax has to be paid on many documents like property sale agreements, rental agreements, mortgage deeds, gift deeds, etc. As per IGR Maharashtra, stamp duty is applicable at the rate of 3% to 7% of the entire transaction price. The rate of tax changes according to the type of document and area. The stamp duty charges can be easily calculated by taking the help of the stamp duty calculator that is present on the website of IGR Maharashtra. The calculation can be easily done by entering the document details on stamp duty on the calculator and after that, you can get an approximate value of the stamp duty.

महाराष्ट्र सीएम हेल्पलाइन नंबर

Steps To Calculate The Stamp Duty Charges Online

- Visit the Official Website Of IGR Maharashtra.

- The home page of the website will appear on the screen.

- On the home page of the website click on the Stamp Duty Calculator option.

- After clicking on the option, you will reach the new page.

- In this step, choose the type of document to be registered. If it is a sale deed, click on the Sale Deed option.

- After selecting the document type, then you choose the municipality for your area.

- After selecting the area, enter the Consideration amount and Market value.

- Click on the calculation option.

- All the detailed information related to stamp duty will be displayed on the screen.

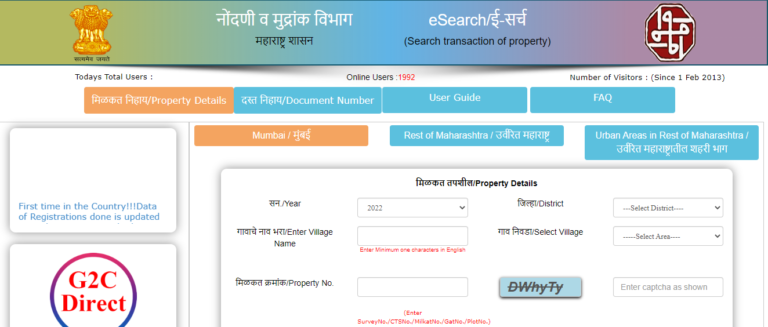

How To Search The Property Registration Details?

Residents of the state can get all information about any property registered in Maharashtra by using the free search tool on the website of the IGR Maharashtra. With the help of this facility, people can now know all details of all properties registered from the year 1985 in Mumbai city and its suburban borders. But for the areas other than Mumbai the information is obtainable only from 2002. The residents should know their property number and year of registration to search for property registration data on the website of IGR Maharashtra.

- Visit the Official Website Of IGR Maharashtra.

- After visiting the website, a home page will appear.

- Click on the ‘E-search’ on the home page.

- After clicking the E search option, select the free process button.

- Now, a new page will open on the screen.

- If you are not registered then you can create an account.

- To log in to the website, click on the login option and enter your login ID and password.

- Then select property areas from the options- Mumbai, Urban areas other than Mumbai, and the rest of Maharashtra.

- Fill in the details of the property- the year of registration, district name, tehsil name, village name, and property no.

- If the resident doesn’t know the correct property then he can enter the survey no., plot no., CTS no, etc.

- Select the property from the list mentioned.

- After selecting of property, click on the Index II option.

- A PDF file including all the registration information will be downloaded.

IGR Maharashtra: Payment Of Stamp Duty & Registration Fees

Citizens can pay stamp duty through the Government Receipt Accounting System (GRAS) that is present on the IGR Maharashtra website (igrmaharashtra.gov.in). The fee can be paid in both ways offline as well as online. IGR Maharashtra also takes the fees. The online process to pay stamp duty and registration charges online is as follows-

- Visit the official website.

- On the home page of the link, click on the Inspector General of Registration tab.

- Now a new page will open, at this page, you have to choose whether you want to pay with login or without registration.

- It is very easy to pay without registration.

- Click on the Pay without registration option.

- You will be directed to the screen to fill in the all details.

- Then select the payment that should be made like, only stamp duty, only registration fees, and both stamp duty, and registration fees together.

- Select the appropriate property district, the sub-registrar office under whose jurisdiction the property comes, and the type of document.

- Enter the stamp duty fee, and if the option of the registration fee is also chosen, then the resident has to pay the registration fee also.

- Fill in all details of the property of the buyer and seller.

- After filling in the details select the mode of payment, whether you want to pay by Credit/ Debit card or internet banking.

- The residents who are able to do online payments will receive a challan through this portal and can pay cash at selected branches of banks.

- Click on submit option.

How to Apply for Stamp Duty Refund?

- Go to the official website of IGR Maharashtra.

- Click on the ‘Stamp Duty Refund’ tab on the home page.

- A new page will appear in front of you.

- Fill in the refund token number and password on the new page.

- Click on ‘View Status. The details of the refund will be seen on your screen.

How to Check Ready Reckoner Rates online?

According toIGRMaharashtra, there is no change in the ready reckoner rates for the financial year 2021-22 because of the pandemic. In September 2020, the changes were done by the department of registration and stamp Maharashtra. A marginal increase of 1.74% in ready reckoner rates was noticed in 2020. The Maharashtra Government has the authority to decide Ready reckoner rates. These are the government-decided rates below which a property transaction cannot take place in a specified area. The rates are also known as, guidance value, and circle rate in Maharashtra.

Steps to check the ready reckoner rates online on IGR Maharashtra-

- Visit the official website of IGR Maharashtra.

- Click on the E-ASR and Process tab.

- You will be directed to the new page.

- You will see a map on this new page.

- Select the area where the property is situated.

- After selecting the area, the screen will be displayed.

- Select the District, Taluka, and Village and the Assessment Type, and Assessment Range on this screen.

- Rates will be seen on the screen.

Other Services of IGR Maharashtra

IGR Maharashtra also offers other services through the website of IGR Maharashtra (igrmaharashtra.gov. in). The services are document registration, Copy and search, Stamp duty collection, Valuation of property, Filing of notices, Stamp duty refund, Deemed conveyance, Marriage registration, Registration of will, etc.

Contact details of IGR Maharashtra

People can contact IGR Maharashtra on Ground Floor, Opposite Vidhan Bhavan (Council Hall), New Administrative Building, Pune 411001, Maharashtra, India.

Phone: 8888007777.

Conclusion – It is the responsibility of the IGR to perform the registration of property-related documents in Government records. It also collects the revenue that is generated. IGR performs all this work by keeping in mind the guidelines of the Registration Act. The office of IGR works with modern technology to help the residents to make proper use of services that are provided by the authority. The website can be accessed in both English and Marathi. The IGR Maharashtra initiative has played an excellent role in providing online services to the residents.