Savings is one of the greatest ways of ensuring the availability of funds in our older age. So, under this article we will provide you all the details about the Post Office Saving Scheme for the year 2019-2020 and as we all know new rates has been introduced under the scheme from 1st October to 31st December. We will tell you all the details about the new updates in the post office saving schemes for the year 2019 and 2020. We will also provide you the table of the rates which has been updated from 1st October to 31st December. Thus, all the vital information is given in the post.

Table of Contents

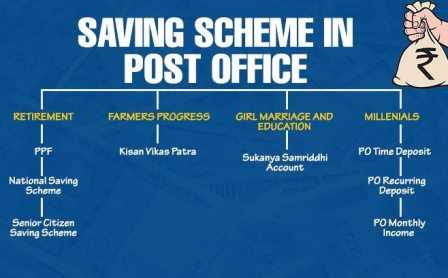

Post Office Saving Scheme 2019-20

To allocate the funds of common public and to provide adequate saving facilities every year new saving schemes are launched under the post office as described by the central government. The central government helps the people to allocate their funds in adequate saving schemes so that they can have a safe and secure old age. The savings scheme under the post office provides good interest rate plus a very good amount at the tenure of the scheme thus, enabling the citizens of India to have a safe and secure future.

Minimum Amount for Opening Post Office Saving Scheme

| Account name | Minimum amount required to open an account |

| Savings account (Cheque account) | Rs. 20 |

| Savings account (non Cheque account) | Rs. 20 |

| Monthly Income Scheme (MIS) | Rs. 1,500 |

| Fixed Deposit (FD) Account | Rs. 200 |

| Public Provident Fund (PPF) | Rs. 500 |

| Senior Citizen Savings Scheme (SCSS) | Rs. 1,000 |

New Rates Under Post Office Saving Scheme

Although some of the schemes of the post office remained the same. Under the following schemes new rates have been launched by the post office authorities:-

- Time Deposit (TD)

- Public Provident Fund (PPF)

- Sukanya Samriddhi account

- Senior Citizen Savings Schemes (SCSS)

- Recurring Deposit (RD)

- National Savings Certificate (NSC)

- Kisan Vikas Patra (KVP)

- Monthly Income Scheme (MIS)

- PO Savings Deposit Account Schemes

Eligibility For Post Office Saving Scheme

| Scheme | Eligibility |

| Post Office Savings Account | Resident Indian , Minor and Majors |

| 5-Year Post Office Recurring Deposit Account | Individual |

| Post Office Time Deposit Account (TD) | Individual |

| Post Office Monthly Income Scheme Account (MIS) | Individual |

| Senior Citizen Savings Scheme (SCSS) | Individual of age> 60 years or age >55 years who have opted for VRS or Superannuation |

| 15 year Public Provident Fund Account (PPF) | Individual |

| National Savings Certificates (NSC) | Individual |

| Kisan Vikas Patra (KVP) | Individual (Adult) |

| Sukanya Samriddhi Accounts | Girl Child – Upto 10 years from birth and 1 additional year of grace |

Kisan Vikas Patra Scheme

Document Required For Post Office Saving Scheme

- Aadhar Card

- Pan Card

- Address Proof

- KYC Form

New Interest Rates In Post Office Saving Scheme

The following table displays the interest rates under different schemes:-

| Post Office Saving Schemes | Interest Rate for 1 October to 31 December 2019 | Compounding Frequency |

| Savings Deposit Scheme Account | 4.0 | Annually |

| 1 Year Time Deposit | 6.9 | Quarterly |

| 2 Year Time Deposit | 6.9 | Quarterly |

| 3 Year Time Deposit | 6.9 | Quarterly |

| 5 Year Time Deposit | 7.7 | Quarterly |

| Recurring Deposit (5 years) | 7.2 | Quarterly |

| Senior Citizen Savings Scheme (5 years) | 8.6 | Quarterly & Paid |

| Monthly Income Scheme Account (5 years) | 7.6 | Monthly & Paid |

| National Savings Certificate | 7.9 | Annually |

| Public Provident Fund Scheme | 7.9 | Annually |

| Kisan Vikas Patra | 7.6 | Annually |

| Sukanya Samriddhi Account Scheme | 8.4 | Annually |

How To Apply For Post Office Saving Schemes

- Any eligible candidate with all required documents may easily apply for Post Office Saving Scheme

- Please visit your regional post office to open any above mentioned Post Office Saving Scheme.

- Submit your all required document with KYC form in the post office where you want to open your saving scheme

- You also visit the official website of the Post office for more queries.