Tax Paying in India have always been an increasing problem and is actually very difficult to achieve. The citizens of India who are actually paying their taxes consist of a very low number. To achieve the desired number of taxpayers in India the Sabka Vishwas Scheme Legacy Dispute Resolution has been launched in the year 2019. Sabka Vishwas (Legacy Dispute Resolution) Scheme is a one-time measure for liquidation of past disputes of Central Excise and Service Tax. It will also help the government to ensure disclosure of unpaid taxes by the citizens.

Table of Contents

Sabka Vishwas Scheme 2019 – 20

The Sabka Vishwas Legacy Dispute Resolution scheme will start from 1st September 2019 and will end on 31st December 2019. It will be a 4 month long scheme which will benefit the government throughout. The Sabka Vishwas Scheme Legacy Dispute Resolution scheme shall announce that all the people who are eligible to pay taxes should clear their previous and past tax dues and pay the amount according to the scheme. It further announced immunities including penalty, interest or any other proceedings under the Central Excise Act, 1944 or Chapter V of the Finance Act, 1944.

New Traffic Rules

What is Sabka Vishwas Scheme?

Legacy Dispute Resolution Scheme is a one-stop solution for liquidation of all pending disputes of service tax, central excise and 26 allied indirect tax acts consensus. it is a Golden Opportunity offer to taxpayers to settle past cases by paying very nominal taxes. It is specially tailored to benefit small taxpayers settle case pending in litigation appeal, inquiry, investigation and audit by paying only 30 percent of tax debts tubes. It is automated electronic payment no interface with the tax officer’s decision within 60 days of application scheme.

Overview of Sabka Vishwas Scheme

| Scheme Name | Sabka Vishwas Yojana |

| Launched by | Mrs. Nirmala Sitharaman |

| Department | Department of Revenue |

| Beneficiary | Taxpayers of India |

| Mode of Application | Online |

| Start date to Apply | 1st September 2019 |

| Last date to Apply | 31st December 2019 |

| Benefits | Solution of Tax Disputes |

| Type of Scheme | Central Govt. |

| Status | Active |

| Official website | https://cbic-gst.gov.in/ |

Objectives of Sabka Vishwas Scheme 2019

Certain objectives have been finalized for the Sabka Vishwas Legacy Dispute Resolution scheme under the year 2019:-

- The scheme is centrally aimed to make the disclosure of past dispute of Central excise, Service tax and 26 other indirect tax possible.

- The motive is to facilitate an eligible person to pay his or her unpaid tax duties.

- The scheme also provide to the people who are eligible to pay taxes certain immunities, including penalty, interest or any other proceedings including prosecution.

Aadhaar Card Status

Benefits in Sabka Vishwas Scheme 2019

Many benefits has been transferred to the taxpayer in India under the Sabka Vishwas Legacy Dispute Resolution scheme of 2019. The list of benefits which can be availed by the taxpayers is given below:-

- Where a SCN has been issued

or an appeal has been filed, or enquiry, investigation or audit against the declaring

has been conducted on or before the 30-06-2019 in which the amount of duty

quantified is:

- Rs. 50 lakhs or less, 70% of the tax dues shall be waived off.

- More than Rs. 50 lakhs, 50% of the tax dues shall be waived off.

- Where the tax dues are relatable to a SCN for late fee or penalty only, and the amount of duty in the said notice has been paid or it is nil, then 100% of the amount of late fee or penalty shall be waived off.

- Where tax dues are in arrears

and the amount of duty is:

- Rs. 50 lakhs or less, then 60% of the tax dues shall be waived off;

- More than Rs. 50, then 40% of the tax dues shall be waived off.

- Where declarant has indicated

in the return form (filed under the Indirect-tax enactment) an amount of duty

as payable but not paid it and the duty of amount is

- Rs. 50 lakhs or less, then 60% of the tax dues shall be waived off;

- More than Rs. 50 lakhs, then 40% of the tax dues shall be waived off.

Feature of Sabka Vishwas Scheme

| In Cases pending in Litigation, Appeal, Enquiry, Investigation and Audit | Amount |

| Duty up to Rs. 50 lakh | Pay only 30% of duty |

| Duty more than Rs. 50 lakh | Pay only 50% of duty |

| In case of tax arrears | Amount |

| Duty upto 50 lakh | Pay only 40% of duty |

| Duty more than Rs. 50 lakh | Pay only 60% of duty |

| If you voluntarily discloses any past dues | simply pay the due amount only |

Note – The candidate shall not be liable to pay any other duty, interest or penalty and his case should not be reopened by the Indirect tax regimen. But if any problem practices are found under the name of the candidate then his case shall undergo specified procedure.

Document Required

- Pan Card

- Aadhaar Card

- Address Proof

- Income Tax Details

- Email ID

- Mobile Number

Restriction under Sabka Vishwas scheme 2019

Certain restrictions have been made compulsory under the Sabka Vishwas Legacy Dispute Resolution scheme of 2019. The list of the restriction that should be followed by the candidates is given below:-

- Tax dues payable can never be paid through input tax credit account.

- The dues of taxes which are already paid shall not be refundable under any circumstances.

The scheme also states that it should not be opted by the following applicants:-

- The applicant who has filed an appeal before appellate forum and final hearing concluded on or before 30-06-2019.

- The applicant who is found guilty for any offence under indirect tax enactment

- Applicant who has been issued a show cause notice (‘SCN’) and final hearing has already taken place on or before 30-06-2019

- The applicant who has been subjected to enquiry or investigation or audit and amount of duty not quantified on or before 30-06-2019;

- applicant who has already filed an application in the Settlement Commission for settlement of a case.

- The applicant who intends to file a declaration with respect to excisable goods which are petroleum, tobacco and related tobacco products as mentioned in the Fourth Schedule to the Central Excise Act, 1944;

- The applicant who makes a voluntary disclosure after being subjected to enquiry or investigation or audit or having filed a return.

Procedure to Fill Sabka Vishwas Scheme Application Form

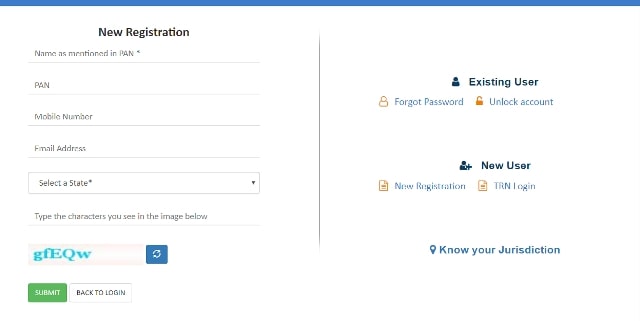

Registration

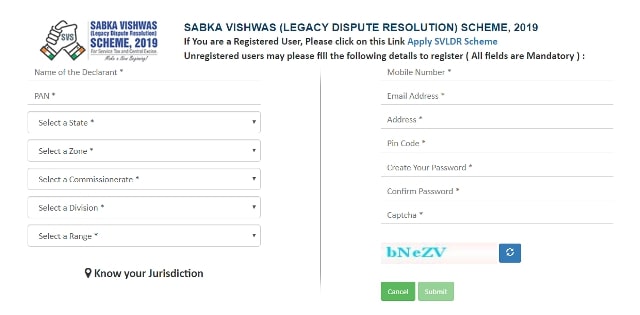

- The Taxpayers who wants to Register under the Sabka Vishwas Legacy Dispute Resolution Scheme Firstly visit at the official website.

- At the homepage of Government of India Sabka Vishwas Legacy Dispute Resolution, you will find “SVLDRS Scheme Application Form” Option.

- Fill the Registration Form with all the Required Details.

- Then submit your Registration Form

Login

- After doing the Successful Registration under the scheme, you have to go for SVLDRS Login Section.

- Now after the successful login fill the Further Details under SVLDRS Application Form.

- Now take a Print Out of Filled Application Form for Future Use.