Savings is one of the greatest ways of ensuring the availability of funds in our older age. So, under this article, we will provide you all the details about the Postal Schemes. we will provide you all the relevant information about the Post Office saving schemes which were launched in the year 2019 and 2020. We will provide you all the benefits available in the Post Office Saving Schemes.

Table of Contents

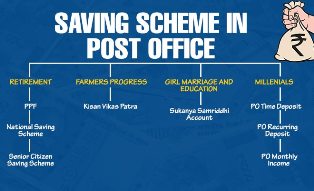

Post Office Postal Schemes

To allocate the funds of the common public and to provide adequate saving facilities Every year New Postal Schemes are launched under the post office as described by the central government. The central government helps the people to allocate their funds in adequate saving schemes so that they can have a safe and secure old age. The Postal Schemes under the post office provides a good interest rate plus a very good amount at the tenure of the scheme thus, enabling the citizens of India to have a safe and secure future.

India Post Saving Scheme

List Of Postal Schemes

- Post Office Savings

- National Savings Recurring Deposit

- National Savings Time Deposit

- National Savings Monthly Income

- Senior Citizens Savings Scheme

- Public Provident Fund

- National Savings Certificates (VIII Issue)

- Kisan Vikas Patra

- Sukanya Samriddhi

More information about the above-mentioned Postal Schemes are available further in this article –

1. Post Office Savings

Under this Postal Schemes, 4.0% interest is applicable per annum on individual or joint accounts.

Features Of The Scheme –

- The post account can open by cash with only Rs 20.

- Minimum balance to be maintained in a non-Cheque facility account is INR 50/-

- Cheque facility available if an account is opened with INR 500/-

- Minimum balance of INR 500/-in an account is to be maintained for cheque facility.

- Interest earned is Tax-Free up to INR 10,000/- per year from the financial year 2012-13

Conditions For The Scheme –

- One account can be opened in one post office only.

- The account can be opened in the name of a minor.

- A minor of 10 years and above age can open and operate the account if you want to.

- A joint account can open by two or three adults.

- One transaction of deposit or withdrawal in three financial years is necessary to keep the account active.

2. National Savings Recurring Deposit

Interest Rates For The Account –

- 7.2 % per annum quarterly compounded.

- On maturity INR 10/- account fetches INR 725.05

Features Of The Scheme –

- A minimum of INR 10/- per month or any amount in multiples of INR 5/- is needed to open the account.

- The account can be opened by cash.

- An account can also be opened by cheque and in the case of Cheque, the date of deposit shall be the date of the presentation of Cheque.

- Transfer facility is available

Conditions For The Scheme –

- Any account can open in one post office only.

- The account can open in the name of a minor.

- A minor of 10 years and above age can open and operate the account if you want to.

- A joint account can opened for two or three adults.

- The subsequent deposit can be made up to the 15th day of next month if an account is opened up to 15th of a calendar month and up to the last working day of next month if an account is opened between 16th day and last working day of a calendar month.

- For non-deposit a fee is charged for each default, default fee @ 0.05 rs for every 5 rupees shall be charged.

- After 4 regular defaults, the account becomes discontinued and Account Holder can revive it in two months.

- There is a rebate on advance deposit of at least 6 installments

- One withdrawal up to 50% of the balance allowed after one year.

- Full maturity value allowed on R.D. Accounts restricted to that of INR. 50/- denomination in case of death of depositor subject to fulfillment of certain conditions.

3. National Savings Time Deposit

Interest Rates for The Account –

- First For 1 year account – 6.9%

- Second For 2-year account – 6.9%

- Third For 3-year account – 6.9%

- Fourth For 5-year account – 7.7 %

Features Of The Scheme –

- The account can open in cash.

- The account can also be opened by cheque and in case of Cheque, the date of deposit shall be the date of the presentation of Cheque.

- Transfer facilities are available.

Conditions For The Scheme –

- Any account can be opened in one post office only.

- The account can be opened in the name of a minor.

- A minor of 10 years and above age can open and operate the account if you want to.

- A joint account can open by two or three adults.

- A single account can convert into Joint and Vice Versa

- Minor after attaining majority has to apply for conversion of the account in his name

4. National Savings Monthly Income

Interest Rates For The Account –

- 7.6 % per annum quarterly compounded.

Features Of The Scheme –

- A minimum of INR 100/- per month or any amount in multiples of INR 5/- is needed to open the account.

- The account can opened in cash.

- The account can also open through cheque and in case of Cheque, the date of deposit shall be the date of the presentation of Cheque.

- Transfer facility is available

- The maximum investment limit is INR 4.5 lakh in a single account and INR 9 lakh in a joint account.

Conditions For The Scheme –

- Any account can open in one post office only.

- The account can open in the name of a minor.

- A minor of 10 years and above age can open and operate the account if you want to.

- A joint account can open by two or three adults.

- A single account can convert into Joint and Vice Versa

- Minor after attaining majority has to apply for conversion of the account in his name

- Maturity Period of the account is five years.

5. Senior Citizens Savings Scheme

Interest Rates For The Account –

The interest will be payable at the end of each calendar quarter e.g. 31st March / 30th June / 30th September / 31st December starting from the day of deposit.

Note – Compounding of interest not permissible.

Eligibility Under The Scheme –

- First He/she must have attained the age of 60 years and above on the date of opening of an account.

- Second He/she must have attained the age of 55 years or more but less than 60 years and who has retired on superannuation or otherwise on the date of opening an account.

- Third He/she must have retired at any time before the commencement of these rules and attained the age of 55 years or more on the date of opening of an account.

- The retired personnel of Defence Services (excluding civilian Defence employees) irrespective of the above age limits subject to fulfillment of other specified conditions.

- NRI is not eligible for the above-mentioned scheme.

- Members of Hindu Undivided Family HUF are also not eligible for the above-mentioned scheme.

6. Public Provident Fund

Interest Rates For The Account –

- 7.9 % per annum quarterly compounded.

Minimum And Maximum Balance –

- The minimum balance must be INR. 500/-

- The maximum balance must be INR. 1,50,000/- in a financial year.

Note:– Deposits can do in a lump-sum or in 12 installments.

Features Of The Scheme –

- The account can open with INR 100/- but has to deposit a minimum of INR 500/- in a financial year and maximum INR 1,50,000/-

- Joint account cannot open.

Conditions For The Scheme –

- Any account can open in one post office only.

- The account can open in the name of a minor.

- A minor of 10 years and above age can open and operate the account if you want to.

- A joint account can open for two or three adults.

- A single account can convert into Joint and Vice Versa

- Minor after attaining majority has to apply for conversion of the account in his name

- Maturity Period of the account is fifteen years (can be extended)

- Premature closure is not allowed before 15 years.

- Interest is completely tax-free.

- Withdrawal is permissible every year from 7th financial year from the year of opening an account.

- Loan facility available from 3rd financial year.

- No attachment under court decree order.

7. National Savings Certificates (VIII Issue)

Interest Rates For The Account –

- 7.9 % per annum quarterly compounded.

- INR 100/- will grow to INR 146.25 after 5 years

Minimum And Maximum Balance –

- The minimum balance must be INR. 100/-

- Maximum no limit.

Features Of The Scheme –

- Deposits qualify for tax rebate under Sec. 80C of the IT Act.

- The interest accruing annually but deemed to be reinvested under Section 80C of the IT Act.

- The account can be opened in the name of a minor.

- A minor of 10 years and above age can open and operate the account if you want to.

8. Kisan Vikas Patra

Interest Rates For The Account –

- The scheme follows an effective rate of interest that is you will receive more funds with an effective rate of interest.

- The current interest rate is 7.7% for the quarter 1 October 2018 to 31 December 2018 prior to which the rate was 7.3%

- Tax Deducted at Source (TDS) is exempt from withdrawals after the maturity period.

- You can use your KVP certificate as collateral or security to avail secured loans.

Conditions Of The Scheme –

- The applicants under the scheme must be of minimum of 18 years of age.

- The applicant must be a citizen of India.

- The applicant must have a working bank account.

- HUF or NRIs are not eligible for the scheme.

- A trust can also by the scheme and avail the benefits.

No special eligibility requirement is finalized for the Kisan Vikas Patra Scheme. People from all over India can apply for the scheme and avail the benefits of the scheme.

Returns Under The Scheme

Returns over the period for an investment of Rs 1000 are as folows:-

- 2 .5 years but <3 years – Rs 1201

- 3 years but <3.5 years – Rs 1246

- 3 .5 years but <4 years – Rs 1293

- 4 years but <4.5 years – Rs 1341

- 4 .5 years but <5 years – Rs 1391

- 5 years but <5.5 years – Rs 1443

- 5.5 years but <6 years – Rs 1497

- 6 years but <6.5 years- Rs 1553

- 6.5 years but <7 years- Rs 1611

- 7 years but <7.5 years – Rs 1671

- 7.5 years but <8 years – Rs 1733

- 8 years – Rs 1798

- 9 years & 10 months ie 100% Return – Rs 2000

9. Sukanya Samriddhi

Interest Rate Under The Scheme

To make the beneficiaries avail of the benefits of the Sukanya Samriddhi Yojana, the interest rate under the scheme has been kept affordable and reasonable. The interest rate for July to September 2019 (Q2, FY 2019-20) is 8.4%

The interest rate has been fixed by the government concerned authorities of the scheme.

Eligibility For The Scheme

To be eligible for the Sukanya Samriddhi Yojana the concerned authority has finalized the following eligibility criteria:-

- The scheme has only been implanted for the girl child prevailing in a household. Thus, the scheme has to be open in the name of a girl child.

- The girl child has to be below the age of 10 at the time of account opening.

- Multiple Sukanya Samridhhi accounts cannot be opened for a single girl child.

- Only two SSY accounts are allowed for a family i.e. one for each girl child.