The Pradhan Mantri Awas Yojana was launched by Narendra Modi in the year 2014 when they won the elections. We have provided you today with all the important details about the Credit Linked Subsidy under the housing scheme which was launched by the Modi Government in the year 2014. Given below in the CLSS Scheme article are all the details about the credit-linked subsidy under the PMAY scheme.

Table of Contents

Credit Link Subsidy Scheme

The credit linked subsidy scheme under the Pradhan Mantri Awas Yojana is taken into consideration to increase the credit flow to the EWS and low-income group category of people. Credit linked subsidy will be provided on home loans taken by eligible urban poor (EWS/LIG) for acquisition and construction of the house.

Aim of CLSS Housing Scheme

The main target of the CLSS Scheme is to provide home loans (at Subsidy interest rate) up to 20 million people belonging to the Low-Income Families, Middle Income Groups and Economically Weaker Sections. Central Government will complete target till 31st March. so hurry up and avail the benefits of CLSS Housing Scheme.

Benefits Of CLSS Scheme

The credit linked subsidy Housing scheme is available for the people belonging to the economically weaker section or the people belonging to the low-income group. Thus, there are several benefits that will be availed by those groups such as:-

- The applicant will gain an interest subsidy at an interesting rate.

- The credit linked subsidy will ensure the credit flow of income.

- The subsidy will encourage more and more people to buy houses under the Pradhan Mantri Awas Yojana.

- The credit linked subsidy will thus help in the development of houses in the country through Pradhan Mantri Awas Yojana.

PMAY Status

Brief Summary of CLSS Home Loans

| Scheme name | Credit subsidy Scheme |

| Launched by | PM Narendra Modi |

| Ministry | Ministry of Housing & Urban Affairs |

| Launched Date | 31st December 2016 |

| Start Date to apply | Available Now |

| Year | 2023 |

| Beneficiary | Middle-income group |

| Subsidy Amount | 2.5 Lakh |

| Category | Central govt. Scheme |

Eligibility For The CLSS Scheme

To be eligible for the CLSS, the applicant must need to follow these eligibility criteria as given below:-

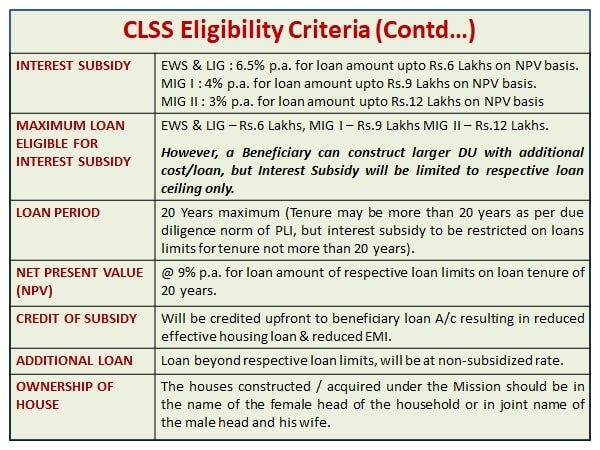

- The credit linked subsidy will be available only for loan amounts upto Rs 6 lakhs and additional loans beyond Rs. 6 lakhs, if any, will be at non subsidized rate.

- Interest subsidy will be credited upfront to the loan account of beneficiaries through lending institutions.

- Credit linked subsidy would be available for housing loans availed for new construction and addition of rooms, kitchen, toilet etc. to existing dwellings as incremental housing.

- The carpet area of houses being constructed or enhanced under this component of the mission should be upto 30 square metres and 60 square metres for EWS and LIG.

- The beneficiary at his/her discretion can build a house of larger area but interest subvention would be limited to first Rs. 6 lakh only.

Rate Of Interest In Subsidy

The following rate of interest has been finalised under the Credit Linked Subsidy scheme:-

- Housing Finance Companies and other such institutions would be eligible for an interest subsidy at the rate of 6.5 % for a tenure of 15 years or during the tenure of loan whichever is lower.

- The Net Present Value (NPV) of the interest subsidy will be calculated at a discount rate of 9 %.

Details Of The CLSS

The details for the Credit Linked Subsidy Scheme are given below:-

| Categories | MIG I | MIG II |

| Annual Income | Rs 6,00,001 – Rs 12,00,000 | Rs 12,00,001 – Rs 18,00,000 |

| Interest Subsidy | 4% | 3% |

| Maximum Loan Tenure | 20 years | 20 years |

| Eligible Home Loan Amount For Interest Subsidy | Rs 9,00,000 | Rs 12,00,000 |

| Discount Rate For NPV | 9% | 9% |

| Upfront Amount Of Subsidy | Rs 2,35,068 | Rs 2,30,156 |

CLSS Subsidy Category Wise

For MIG-I

| Income Category | Up to Rs 12 lakh |

| Original Loan (A): At 8.5 % for 20 years | Rs 9 lakh |

| EMI | Rs 7810 |

| Total Interest (20 yrs) | Rs. 9,74,498 |

| NPV: After subsidy of 4% (B) | Rs. 2,35,000 |

| Reduced Loan (A-B) : At 9 % for 20 years |

For MIG-II Category

| Income Category | Up to Rs 18 lakh |

| Original Loan (A): At 8.5 % for 20 years | Rs 12 lakh |

| EMI | Rs 10,414 |

| Total Interest (20 yrs) | Rs 12,99,331 |

| NPV: After subsidy of 3% (B) | Rs. 2,30,000 |

| Reduced Loan (A-B) At 8.5 % for 20 years | Rs. 9,70,000 |

How to Apply Online CLSS Housing Scheme

Economical Weaker Section (EWS)/Lower Income Group (LIG)/Middle Income Group (MIG) may apply under CLSS subsidy to purchase/construction/extension/improvement of house at the nearest banks and housing loan finance company. To get more detail about CLSS Home Loans Scheme application process contact to the home loan finance bank or company.

CLSS Toll-Free Helpline Numbers

- NHB: 1800-11-3377, 1800-11-3388

- HUDCO: 1800-11-6163